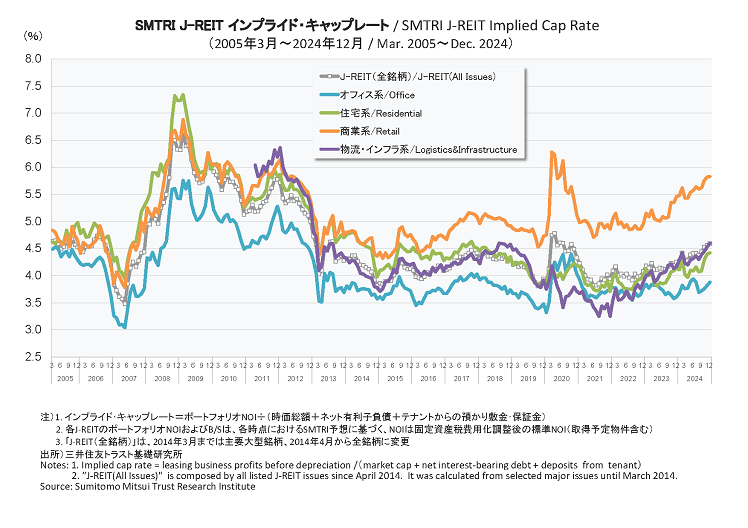

Here, we introduce the Implied Cap Rate calculated by Sumitomo Mitsui Trust Research Institute.

These indices may be used as benchmarks for investment in J-REITs.

Implied Cap Rate

[ updated February 14, 2025 ]

- The Implied Cap Rate is the yield given by dividing the NOI (Net Operating Income) from managed properties by the Implied Value of a J-REIT. The Implied Value is the total of the market cap and debts of the J-REIT, and represents its acquisition value in the capital market.

- In another word, the Implied Cap Rate represents the yield of NOI produced at a certain share price. It is used as a benchmark for the investment decision, and also as a hurdle rate for the J-REIT manager to compose their property portfolio.

Our indices show;

- The fluctuation of the Implied Cap Rate for the J-REITs listed on the Tokyo Stock Market since March 2005.

※The Implied Cap Rate of " J-REIT(Major Issues)" altered to " J-REIT(All Issues)" from April 2014, due to the change in Implied Cap Rate constituents. For comparison, difference between Implied Cap Rate of " J-REIT(Major Issues)" and " J-REIT(All Issues)" on March 2014 is 0.04 pt.

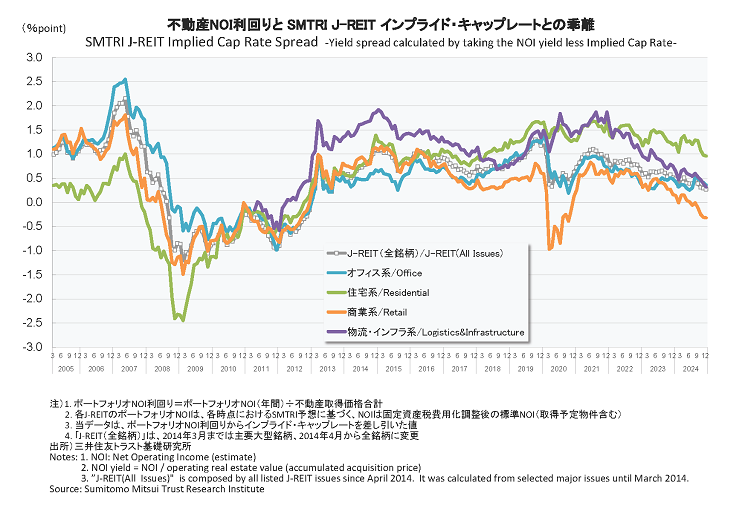

- The spread between the weighted average NOI yield and the Implied Cap Rate.

- SMTRI J-REIT Implied Cap Rate is calculated monthly. Basically the graphs are released at the middle of each month after a two month delay.

Notes on usage

- Implied Cap Rate and NAV of J-REITs presented on this website is the intellectual property of Sumitomo Mitsui Trust Research Institute, and all rights related to this information belong to Sumitomo Mitsui Trust Research Institute.

- Before using the data or graphs on this website for purposes such as the provision of information or the composition of financial instruments, please direct any inquiries concerning consent procedures and other matters to the department in charge indicated below. When the data or graphs is used strictly for one's own research purposes, without indicating or providing such information to third parties, such inquiry is not necessary.

- The intention of Sumitomo Mitsui Trust Research Institute is to provide the information only to users of this information. This information is not provided for purposes such as application for, inducement of, or intermediation in sales or other transactions involving products, services, or rights, including financial instruments.

- Based on its own judgment, Sumitomo Mitsui Trust Research Institute may update, make additions to, revise or delete in whole or in part, or otherwise modify the content of this information without providing advance notice thereof to users of the information.

- Sumitomo Mitsui Trust Research Institute may suspend or terminate the calculation or provision of Implied Cap Rate and NAV through this website, without providing advance notice thereof to users of this information, in cases such as the following: when the content of this information is updated, additions are made to it, or it is revised or deleted in whole or in part; when system maintenance or inspection is conducted; when equipment, cables, etc. are damaged or their service is suspended; or when such suspension or termination is unavoidable as a result of power outages, natural disasters, or other factors.

- Sumitomo Mitsui Trust Research Institute shall not be responsible for any losses or damages incurred by users of this information for reasons such as the updating of, the making of additions to, or the revision or deletion in whole or in part of the content of this information, or the suspension or termination of the provision of this information.

- Under no circumstances does Sumitomo Mitsui Trust Research Institute guarantee the accuracy of information on Implied Cap Rate and NAV presented on this website, and Sumitomo Mitsui Trust Research Institute shall not be liable for any errors in the figures used in the calculation of Implied Cap Rate and NAV.